With double-height ceilings, and open-plan living areas offering plenty of light and space, barn conversion projects are quintessentially the classic example of property recycling.

Technology advancements mean conversion projects are also more energy efficient in comparison, and schemes that can combine the style and features of the original building with the practicality and comforts of a new build tend to enhance in value. Despite the enduring popularity of barn conversions, changes in the insurance market have meant that many building warranty providers have become less amenable to cover these types of projects. As a result, many brokers in the market will often recommend alternative products such as a professional consultant certificate. However, having all of the key relationships and knowing which underwriters want to write which type of cases, it is possible to secure a barn conversion insurance policy that is backed by an A-rated provider.

Funding a barn conversion can also have its challenges. Whilst traditional development finance is the most popular way to fund the conversion of barns to liveable homes, there are other options available for borrowers. Term mortgages are only available for properties considered “habitable”. Hence, securing a mortgage will only be possible if a property can reasonably be lived in. This is where short-term bridging facilities become a vital tool in a developers arsenal.

Barn Conversion Insurance and Property Finance: Case Study

Our client:

An established Northamptonshire-based property professional approached us to secure barn conversion insurance their upcoming scheme. Having been advised by a broker that an A-rated warranty was unobtainable, the developer engaged Johnny Leadsom to deliver appropriate, A-rated cover.

The project:

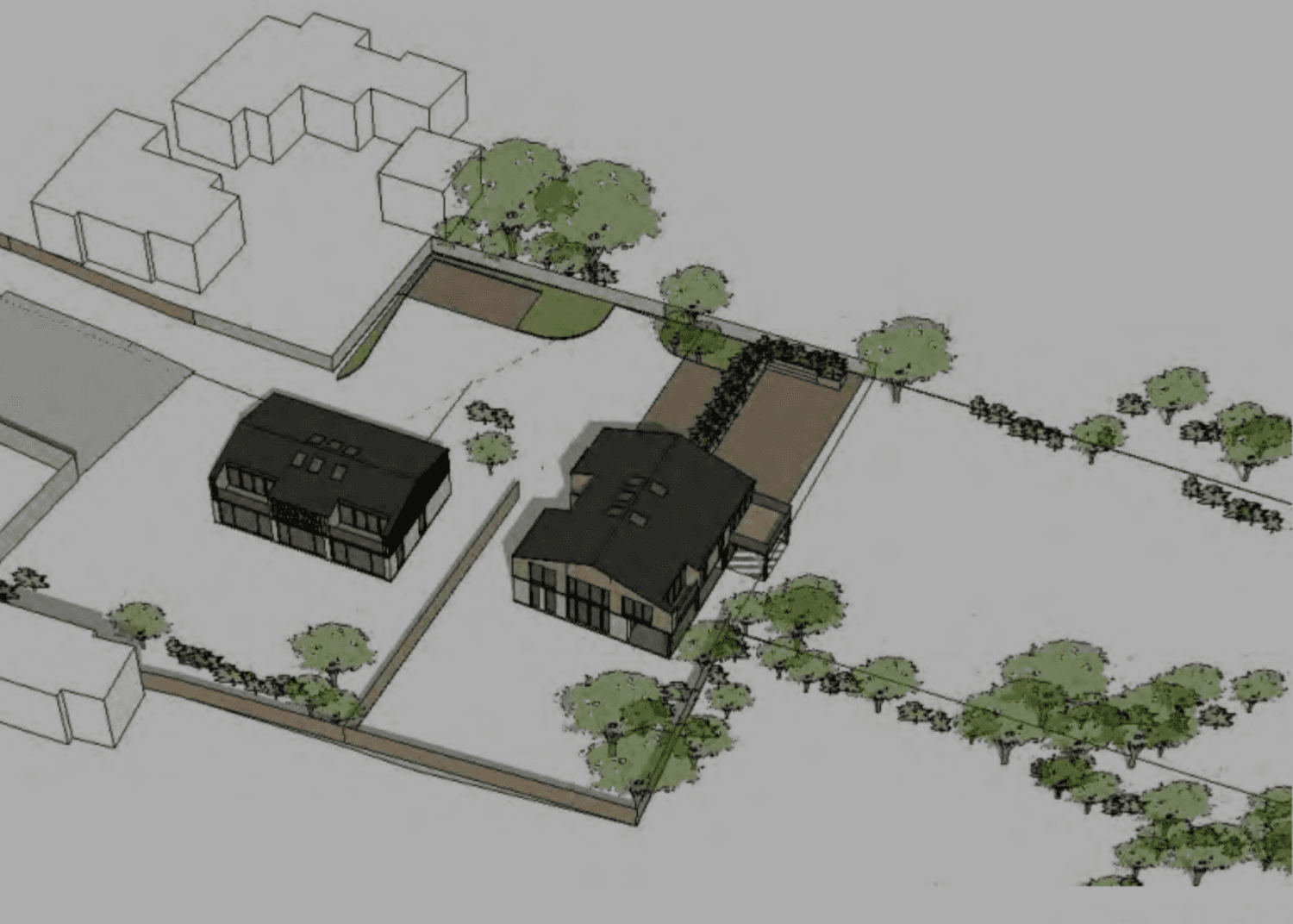

Their project involved converting two former agricultural buildings into two barn-style residential units with contemporary luxury finishes. With planning in place, the project involved stripping out the former barns, putting in a steel framed structure, and then fitting out as a pair of residential units with a GDV of over £1m+.

The solution:

Johnny was able to secure terms within the stipulated time frame from an A-rated conversion warranty insurance provider covering the full reconstruction value of the project.

While discussing the intricacies of the project, it became apparent that the developer was facing challenges around funding, specifically relating to excessive facility and associated fees.

Given Johnny and J3’s multidisciplinary approach, which includes the ability to arrange funding across the equity stack, J3 was tasked to deliver a funding solution that ticked all the boxes.

The client had an offer from a well known development funder which would allow for the conversion and subsequent sale/refinance of the barns; however, it was felt that the facility wasn’t suitable for two reasons.

- Firstly, there was a need for an Independent Monitoring Surveyor (IMS) both to produce an initial report and then subsequently visit the site every month at a cost to the client.

- Secondly, this facility was structured with expensive non-utilisation fees and the client wasn’t entirely sure if all the money would be required as proceeds from another sale were expected.

J3 Director, James Mole was able to structure a 1st charge non-regulated bridge facility that was secured against a portion of the clients buy-to-let property portfolio. This facility could be drawn in tranches and had no requirement for a IMS to have to visit the site. Neither did it have any non-utilisation or exit fees. The end result was a more cost effective solution that better suited the developers needs.

Structural warranty considerations for barn conversion schemes:

With a hardening insurance market and limited capacity across the board, underwriters have become more selective with the risks that they offer terms on. It is recommended that the barn conversion insurance is secured before a spade goes into the ground or soft strip is completed. In addition, the insurer will need to sight over the following documents in order to provide an indicative quote:

- A detailed site plan

- Photographic evidence in colour photos showing all sides of the building ( both internal and external)

- A structural report from a Building Surveyor or Structural Engineer documenting the condition of the structure and its suitability for conversion

- Ground investigation report (soil strength tests and contamination tests)

Average cost of a barn conversion:

According to Homebuilding & Renovating, the average cost for a barn conversion is roughly £1,700 per square meter. However, there are a number of factors impacting this cost (including materials used, size of the barn, layout of the barn etc) that could elevate this cost significantly, reaching as high as £2,500 per square meter or even more.

Types of finance available for barn conversion projects:

Finance for barn conversions can vary quite considerably. Depending on the nature of your project, you may benefit from the following types of finance:

A bridging loan is a short term facility that can provide borrowers with funds to, in this case, buy and convert a barn into saleable homes. Once the project is completed you should be able to either sell the projects or get a term mortgage to repay the loan. Bridge loans work well in scenarios like this if there is either a small amount of work to be undertaken and or if there is additional security in the background.

Development finance may be better suited to a project than a bridge loan for many reasons, including if:

- The cost of the works exceed 50% of the pre development value

- You plan on knocking the existing barn down or undertaking significant structural works

- If you are planning multiple conversions/developments

Costs involved in a barn conversion

We would recommend considering the following costs for a barn conversion scheme :

- Underpinning for added stability

- Reinforcement of walls and timber, addressing cracks or holes.

- Asbestos removal if present

- Repointing to restore structural integrity

- Resolving issues related to dampness and mold

- Enhancing insulation levels

- Full replacement of the floor structure

- Implementing tanking or damp-proofing solutions

- Expenses related to sympathetic window replacement and historical integration

- Building warranty for barn conversion

Process for securing a mortgage for barn conversion

You should always start by checking if the barn has existing planning permission. If you are rebuilding instead of converting, full permission will likely be required. Conversions will usually only require Permitted Development Rights. Lenders will also want to ensure that there are no agricultural restrictions, which can be expensive to remove and that there is a clear right of way.

In certain instances, barn conversion mortgages can provide up to 95% of the current value of the barn and then up to 95% of the works. Funds will be released in arrears in stage payments that are linked to the ongoing valuation during the build.

If you would like more information about barn conversion insurance for your upcoming conversion project, please give us a call on 020 3096 0718