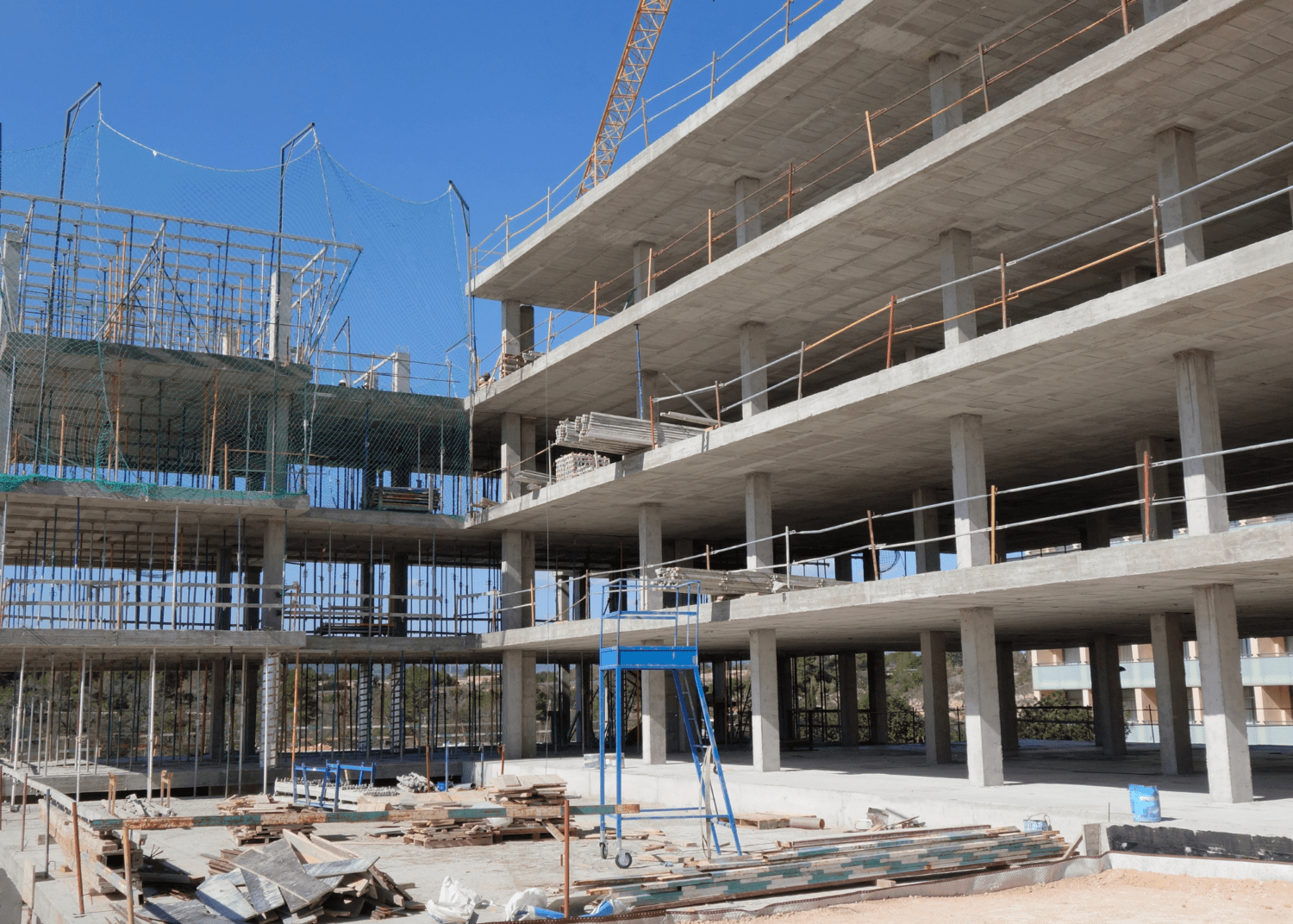

We are seeing increasing interest from developers seeking finance and retrospective warranties for part-complete and near-completed development projects.

Recently published reports by sector specialists have painted a rather bleak picture of the months ahead for the construction industry as economic conditions push up costs and dent demand for new projects. The reasons range from contractor insolvencies to project delays owing to cost overruns to poor debt structuring in the first place resulting in the site going up for sale. While these are complex situations, the current environment offers an opportunity for experienced developers to purchase undervalued sites, which can mean higher returns for savvy developers.

A scheme part-way through construction isn’t the most attractive proposition for insurers, as many in the market need more capacity or capability, to begin with. Neither is it the most attractive proposition for lenders as they haven’t been able to monitor the works to date. However, developers with solid experience and a strong professional team are often able to satisfy the due diligence requirements by lenders and insurers, provided the risk is appropriately presented across the insurance and funding markets.

Retrospective Warranties for Part-Complete Sites:

A retrospective building warranty, also known as a completed home warranty, specifically covers completed units that have not benefited from regular inspections from a structural warranty perspective. This completed house warranty provides cover against damage caused by defects in the design, construction work, and materials for a period of 10 years. While it is not a legal requirement, all mortgage companies will require this warranty to be in place in order to facilitate the sale of the unit and peace of mind for the end purchaser.

A completed or part-completed property is often perceived to be a greater risk as the insurer has yet to have the opportunity to oversee key phases of the build, and this has a direct impact on the cost of the warranty for part-complete and completed schemes. Developers should budget roughly 2.5% of the reinstatement cost for their completed house warranty or to obtain an instant indication, click here.

Documents required to secure a retrospective warranty quote for completed home developments:

- Existing Floor Plans & Elevations

- As-Built/ Construction proposed Floor Plans, Elevations & sections

- Scope of Works/ Specification

- Accommodation Schedule

- Structural Condition Report/ Engineers Design & Calculations

- Ground Investigation Reports/ Geotechnical Surveys (if applicable)

- Underpinning design/engineer’s signoff (if applicable)

Development Finance for part-complete sites: Finish & Exit Facility

The Finish & Exit finance is a funding solution for partially completed projects where continuing with the current funder no longer represents the most suitable way to get the scheme to completion. This could be for a variety of reason but it’s normally

- The current funder can no longer advancing payments due to:

- Construction timeline delays

- Cost overruns

- Covenants being breached

- Or that a more cost effective lender can now step in

Finish & Exit Finance Facility: Supporting documents required

While this isn’t an exhaustive list, an overview of the information that would be required from various stakeholders is listed below:

- Updated financial appraisal

- Overview of works to date and the rationale for a change in funding strategy

- Latest valuation report

- Latest Bank Monitoring Surveyors report

- Details of project funding to date

- Schedule of costs incurred together with the current construction programme

- Updated cash-flow and anticipated costs to complete

- Schedule of contractors and professional teams involved with the project.

- Building regulation and copy of building control report.

- Insurances/warranties including:

- Contractors’ All Risk Insurance/existing Buildings Insurance (if applicable).

- Public Liability.

- New build warranties

- Collateral warranties

- Legal:

- Up-to-date searches

- Confirmation as to whether there are any known legal disputes

Retrospective warranties & Finance for part-complete and completed schemes:

At J3, we understand the risk appetite of the various lenders and insurers as well as how to best structure deals for our clients, which is why we have been very successful for our clients. The current economic climate will create some casualties in the marketplace, but with that, new opportunities will present themselves to others.

If you would like more information about development finance or completed home warranties, please give us a call on 020 3096 0718